What is portfolio monitoring in private equity?

To answer this question, it’s important to firstly understand the mechanics of private equity.

How does private equity work?

Private Equity firms seek out underperforming or undervalued companies. By working with these companies, managers unlock significant value by:

- Improving business strategy

- Injecting managerial expertise

- Advancing product technology

- Expanding distribution

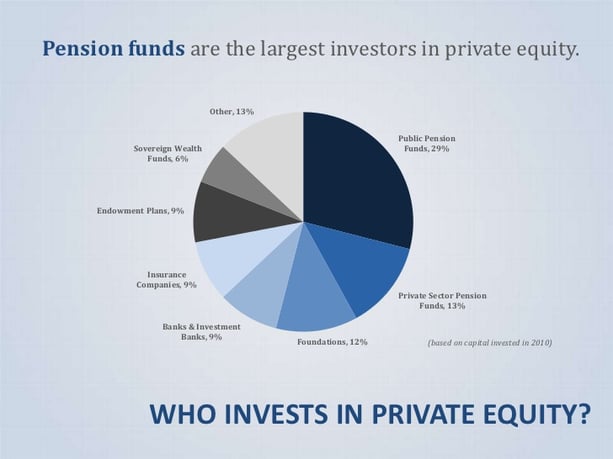

Who invests in private equity?

Commonly described as institutional investors, investors are typically made up of public and private pension funds, foundations, and endowments.

Image source: Private Equity Growth Capital Council Private Equity 101: Anatomy of an investment

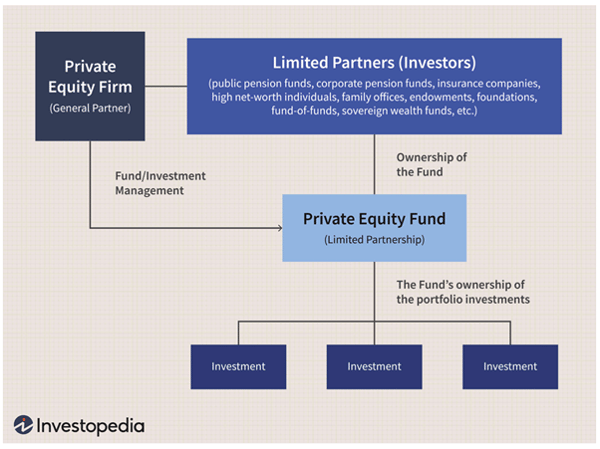

Private Equity Stakeholders

Private Equity has two distinct sets of stakeholders:

- The Private Equity firm – the General Partner (GP);

- and Limited Partners (LP) - the investors.

The General Partner manages the fund and the Limited Partners are the owners of the fund. A General Partner will also have several stakeholders that each perform specific roles, including investment directors, financial directors and partners.

Image source Investopedia

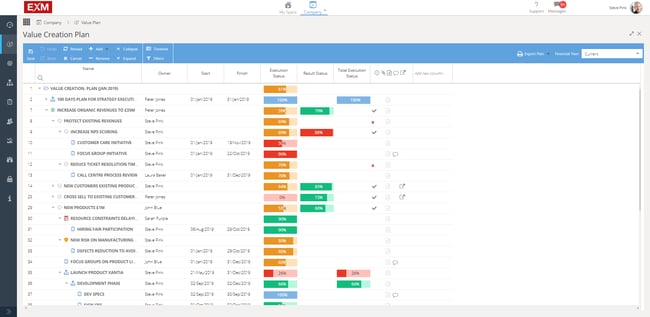

The Value Creation Plan

Once a General Partner has identified a company that it wants to acquire and performed the proper due diligence it will create the ‘value creation plan’ for the company. The value creation plan defines the projects and actions that will be put in place to increase its value.

A typical value creation plan may look something like this:

Source: EXM.cloud

Portfolio Monitoring

Over the lifecycle of a company backed by private equity the Portfolio Manager is responsible for monitoring the financial performance of the portfolio company.

For private equity and venture capital firms, portfolio monitoring refers to the way in which the critical performance metrics are collected, monitored and tracked across the portfolio companies, and the active funds.

Regardless of the portfolio company or fund, the process is largely the same: data and other relevant information is gathered from the portfolio and used to produce quarterly reporting which all stakeholders - usually the Board, investors and internal teams - use to assess the success of the value creation plan and the overall portfolio health.

What key metrics does a private equity manager need to monitor?

According to the BVCA “Private equity is an asset class with the potential to generate sustained, long-term outperformance for its investors, and is a key component of many investors’ portfolios. One of its defining features is the irregular timing of cash flows from investors to fund managers and vice versa. As a result, a number of different metrics have been adopted to give investors the greatest possible understanding of the performance of their private equity investments.

It is important to stress that no single measurement represents the right or wrong way of measuring the performance of private equity and venture capital investments. Individual investors and fund managers will find that different combinations of these metrics will work best for them in assessing their private equity and venture capital investments”1

While there is no perfect science to value a private equity portfolio, there are common Key Performance Metrics or Indicators (KPI’s) accepted within the industry including:

Gross and Net IRR

The internal rate of return (IRR) is a metric used to measure and compare returns on an investment. It calculates the return by looking at all the cash flows from the investment over a given period.

Multiples Calculations or TVPI

TVPI (Total Value to Paid In) measures the overall performance of a PE fund with a ratio of the fund’s cumulative distributions and residual value to the paid-in capital. It calculates what multiple of the investment would be returned to investors if the unrealised assets were sold at current valuations and added to distributions that had already been received.

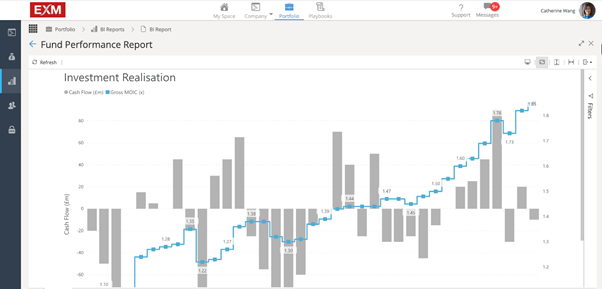

The data collected and analysed with a portfolio monitoring tool will provide the necessary inputs to calculate the metrics listed and any other calculations a fund might use to benchmark performance. These benchmarks can be run across a single company, across the fund, or across the entire portfolio of realised and unrealised investments. Monitoring portfolio performance will vary from firm to firm and GPs will have their own method of calculating their value.

The following is an example of a Fund Performance Report in UNTAP by EXM.

GPs are measured by the value they create within their portfolio and return to their investors. In the past decade investors have become more discerning in their evaluation of GPs and in turn it has become crucial for GPs to track and communicate how well each asset they own performs. Portfolio monitoring is the key component to measuring performance, and GPs have added sophistication to their portfolio monitoring process through both technology and personnel.

Private equity will always be a bottom-line industry and portfolio performance will continue to be the final measure between the top and bottom tier.

Next-generation solutions for private equity portfolio monitoring

The private equity industry has historically leaned on manual processes and spreadsheets to evaluate the performance of their private equity investment portfolio. But with the emergence of new digital technology the tide is starting to shift in the private equity community to next-generation solutions that do more than just monitor their investments, but also future-proof their value creation planning and set them apart in their fundraising efforts.

With COVID-19 shining the spotlight firmly on private equity and managers facing even more scrutiny over reporting to LP's, having the right tools in place to monitor private equity investments has never been more critical.

If you would like to learn more about how to take your private equity portfolio monitoring to the next level and and get some power behind your portfolio, check out our brochure for more information.

Further reading

Benefits of portfolio monitoring software for private equity

Are you considering private equity portfolio monitoring software?

When is the right time to think about portfolio monitoring software?

1 Source Private Equity Performance Measurement BVCA Perspectives Series

/LOGO_WHITE_2022.png?width=3357&height=959&name=LOGO_WHITE_2022.png)

/LOGO_BLACK_2022.png?width=1000&height=286&name=LOGO_BLACK_2022.png)

Submit a comment