Complete Understanding of Your Funds' Performance

Comprehensive reporting, cash-flow projections and scenarios, and IRR calculation for a real-time view of all your investments.

Fund Cashflow Projections

Multi-year cashflow projection to achieve insights for GPs and LPs.

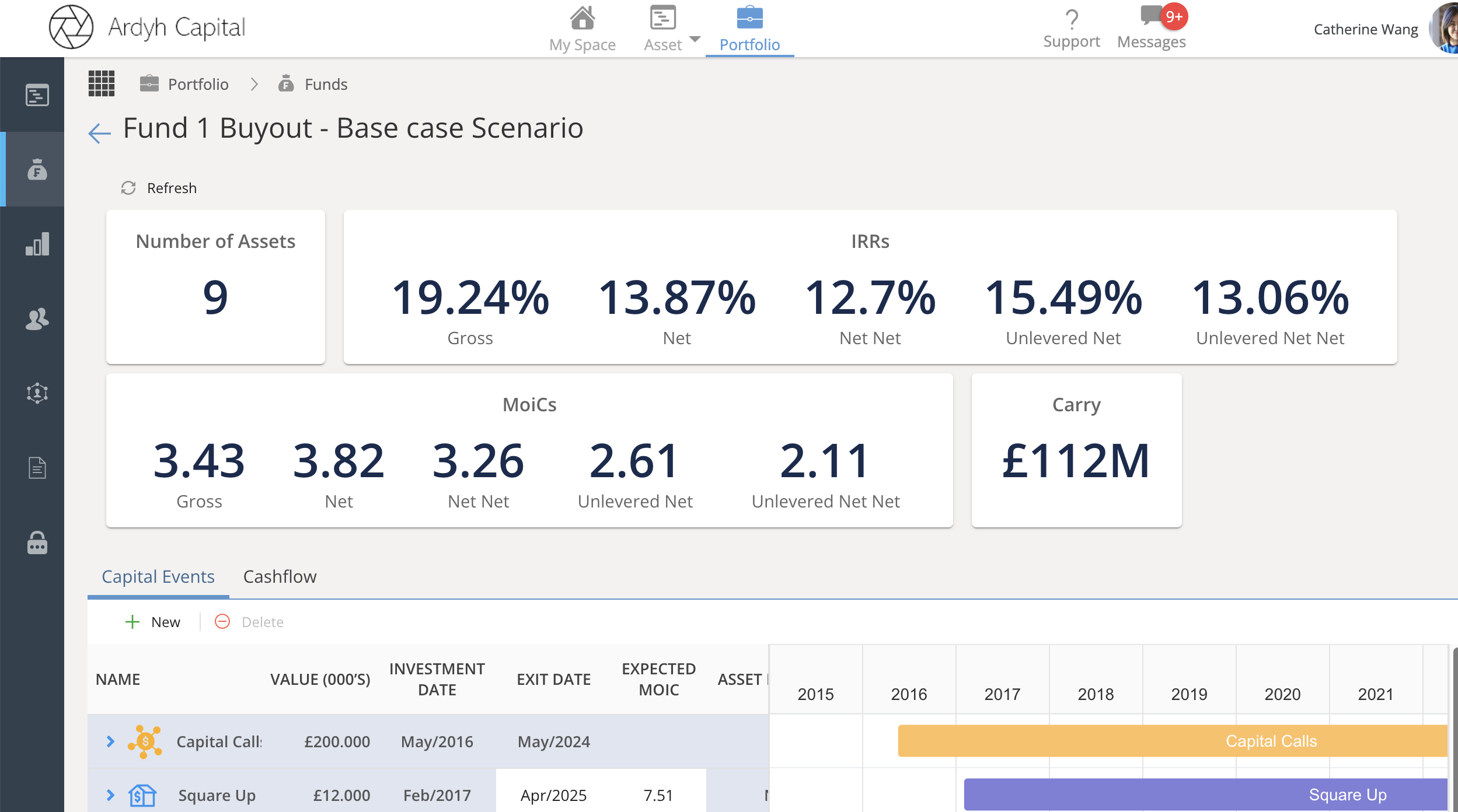

What-if Scenario Analysis

Modelling future performance scenarios to calculate projected IRR and Carry.

Leveraged & Un-leveraged Returns

Automated calculation of returns, existing and future projected.

Comprehensive Reporting

Simplify and elevate your monthly/quarterly investor reports in One-Click.

Supporting every type of capital markets funds

.png)

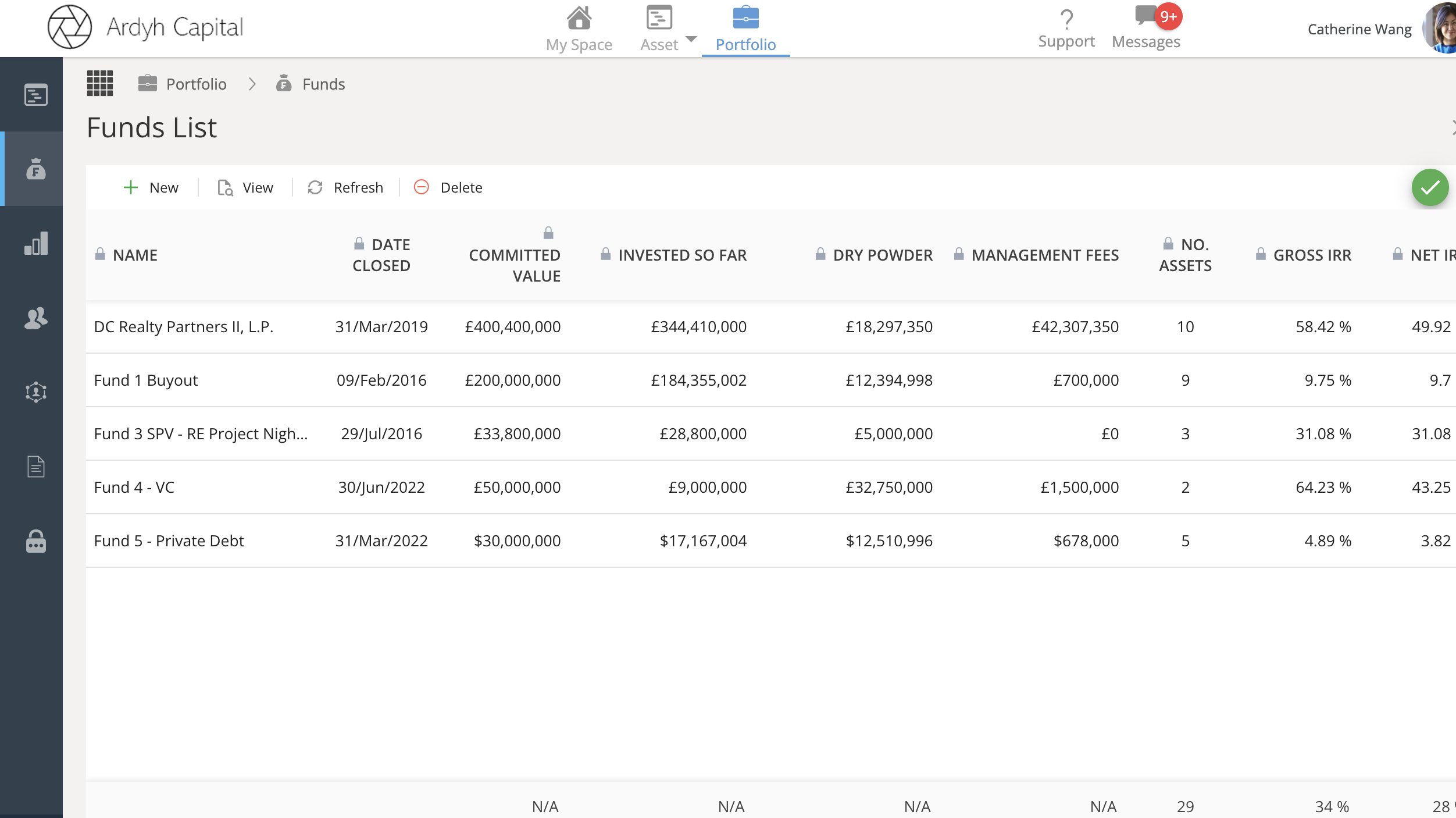

A clear view and insight into all your portfolio assets

IRR, MOIC, and Carry calculation + scenario-building

Robust data integrity process to ensure 100% information reliability

CREATED FOR PRIVATE EQUITY, WITH PRIVATE EQUITY

We work with our customers to provide a tailored, flexible solution that meets their exact challenges in portfolio monitoring.

From the Blog

Why funds wait too long to modernise portfolio operations

28 January, 2026Most private capital funds know their portfolio operations could work better. They see the pressure building every quart...

Why valuation accuracy is now a competitive advantage

21 January, 2026Valuation has always been central to private capital. What has changed is the role it plays in day to day decision makin...

What CFOs actually need from portfolio data

14 January, 2026For CFOs in private capital markets, portfolio data has never been more available. Yet availability is not the same as u...

/LOGO_WHITE_2022.png?width=3357&height=959&name=LOGO_WHITE_2022.png)

/LOGO_BLACK_2022.png?width=1000&height=286&name=LOGO_BLACK_2022.png)

.png?width=331&height=92&name=causeway-removebg-preview%20(1).png)