Value Creation & ESG

Untap maximises your insights to achieve faster and better decision-making

Control your journey

Full investment lifecycle support, from due diligence and 100-day plan, through bolt-on integration and exit.

All on the same page

Untap maintains all key stakeholders aligned and focused on initiatives that have the highest impact on value.

Easy progress updates

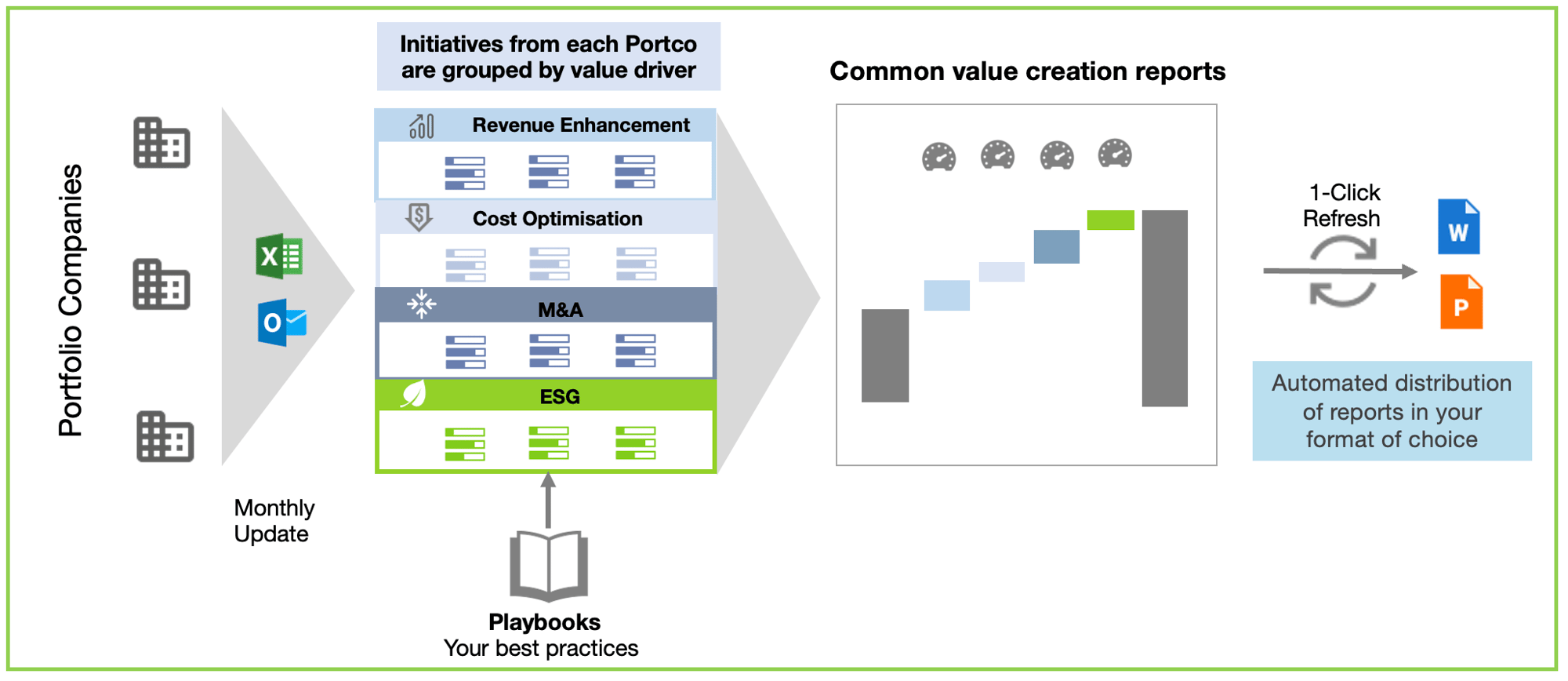

Updating progress via Excel plug-in or directly online to keep everyone informed of the status of the Value Plan.

Deeper Insight

Standard reporting framework provide a common language for communication from the executive team to the board.

Use your Know-How

Translate your knowledge into Playbooks that are automatically triggered when results are not going as planned.

Increase your agility

Untap provides the data insight needed for faster and more effective decision making at the board level.

How you create value

Common framework to measure effectiveness of value creation, connecting financial and operational performance.

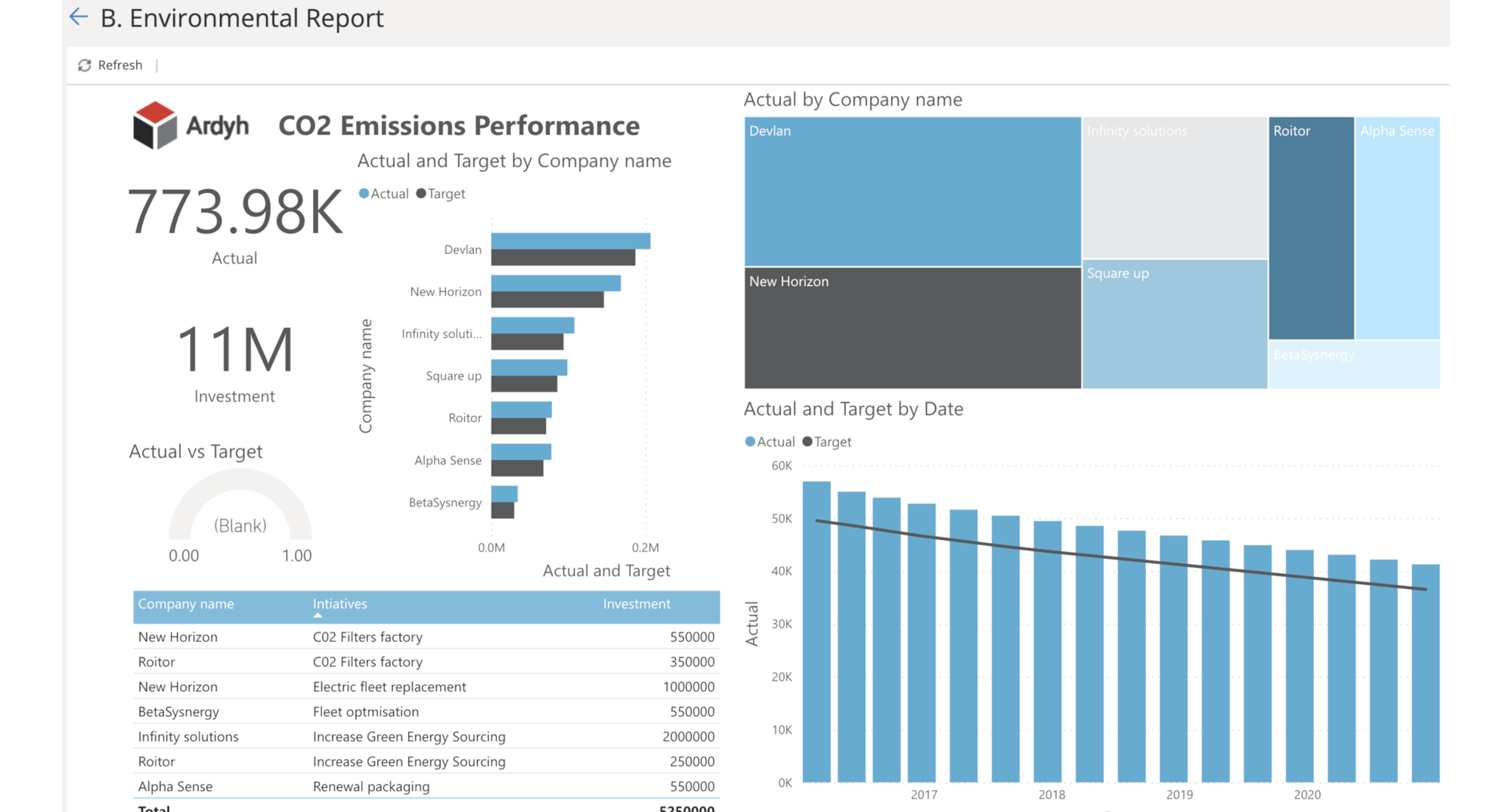

Real ESG Impact

Build ESG improvements directly into the Value Creation Plan to ensure the right focus on ESG opportunities.

The full picture of your value creation

Deep ESG insight

across your portfolio

-1.png?width=2000&height=1075&name=Untap%20Screenshot%20Value%20Bridge%20(1)-1.png)

Align. Orchestrate. Maximise

Align

Strengthens alignment with the leadership team by identifying and continuously sharing objectives. Planning is simplified and every area of growth is clear and transparent.

Orchestrate

Execute plans and track progress. A repeatable model that keeps teams focused, following best-practice, building value, reducing risks and motivating all team members to deliver value.

Maximise

Enhanced focus on value creation and increased visibility of strategy execution keep teams aligned with the overall plan and empower them to deliver their actions and objectives.

A strong & scalable framework for your value creation

From the Blog

Why funds wait too long to modernise portfolio operations

28 January, 2026Most private capital funds know their portfolio operations could work better. They see the pressure building every quart...

Why valuation accuracy is now a competitive advantage

21 January, 2026Valuation has always been central to private capital. What has changed is the role it plays in day to day decision makin...

What CFOs actually need from portfolio data

14 January, 2026For CFOs in private capital markets, portfolio data has never been more available. Yet availability is not the same as u...

/LOGO_WHITE_2022.png?width=3357&height=959&name=LOGO_WHITE_2022.png)

/LOGO_BLACK_2022.png?width=1000&height=286&name=LOGO_BLACK_2022.png)

.png?width=331&height=92&name=causeway-removebg-preview%20(1).png)