Financial Results + Value Creation + ESG

= Portfolio Management

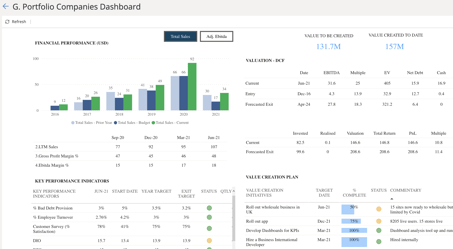

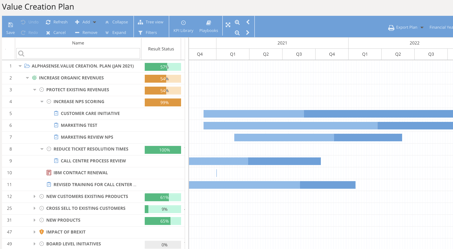

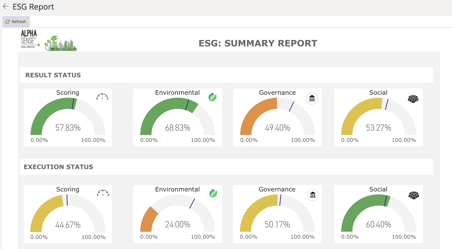

UNTAP Portfolio Management cloud software helps private equity funds consolidate financial results, value creation planning and ESG metrics to achieve:

![]() Increased confidence of achieving growth in Earned Value.

Increased confidence of achieving growth in Earned Value.

![]() Increased confidence of achieving sustainable returns.

Increased confidence of achieving sustainable returns.

![]() Improved transparency between investors and portfolio companies.

Improved transparency between investors and portfolio companies.

Combining ESG metrics with your VCP and portfolio monitoring means that you can measure, benchmark and improve your sustainability goals and clearly demonstrate to your stakeholders the positive improvements that are being achieved to drive sustained growth.

-

The bigger value that we needed to get out of Untap was something that we could use across our whole portfolio to link up all of the various stakeholders. You can see the information flow from the portfolio companies back office all the way to LP reporting

Warren Gee Chief Portfolio Officer, Cairngorm Capital

-

We were looking for a digital solution to help increase our efficiency but also support our ESG and Value Creation strategies, to give us a forward-looking perspective as our portfolio expands. We reviewed many solutions but Untap stood apart for the innovative quality of their platform and their strong commitment to a real partnership with us

Razzak Akbar Chief Financial Officer, Freshstream

-

The great thing about the relationship is that they’ve been flexible and can tweak things for us. So, we’ve made a few fundamental tweaks along the way and we’re getting to the point where we’re 100% happy and things change anyway so it’s been really flexible to enable us to change when we need to

Ian Baldwin Co-Chief Executive Officer, BSO

-

Untap is a solution that is relatively quick to implement and the Untap team has given us great support both during and after implementation in our portfolio

Portfolio Manager

Untap announces new partnership with BDEV Ventures

14 June, 2024The Untap Team is delighted to announce a new partnership with BDEV Ventures, an international investor supporting innov...

The Keystone of Transparency: Consistent Valuation in the Private Equity Industry

25 March, 2024In the nuanced realm of private equity (PE), where the intricacies of valuation underpin the very foundation of investme...

Navigating SEC Rule RIN 3235-AN07: Timely Reporting and Transparency

19 March, 2024For an in-depth analysis of SEC regulation RIN 3235-AN07, focusing on the critical aspects of timely quarterly reporting...

/LOGO_WHITE_2022.png?width=3357&height=959&name=LOGO_WHITE_2022.png)

/LOGO_BLACK_2022.png?width=1000&height=286&name=LOGO_BLACK_2022.png)